Over the past few years, cryptocurrency markets have evolved from the simple trading of digital assets to a broader range of products designed to generate consistent income. Previously, price volatility-oriented investors now enter interest-bearing accounts, staking programs, and managed products to earn returns on digital assets. This shift reflects a broader trend in global finance, where individuals are turning to alternatives to traditional savings accounts and short-term bonds, particularly when interest rates are unstable and inflationary forces are at work. Platforms that can combine competitive returns with protection facilities have become increasingly significant to both retail and professional participants.

Here, yield-producing products have emerged at the heart of the evolving digital economy. Exchanges and decentralized exchanges have emerged to offer savings and investment features that align risk with reward, allowing users to have complete control over their funds. The focus on security, open books, and flexible terms is indicative of a maturing market. It is against this background that Bitunix, a global cryptocurrency exchange founded in 2021, introduced its own passive earnings product, Bitunix Earn, in 2025. In the process, the company placed its platform to meet a growing demand for services that went beyond trading to long-term asset management.

Bitunix Earn was launched in April 2025 and created to appeal to a wide variety of crypto investors. The product suite is divided into three broad categories: Flexible Savings, Fixed-Term Savings, and Dual Investment. Every choice is designed with individual user profiles in mind, from risk-averse savers requiring liquidity to astute traders seeking greater returns with controlled exposure. The strategy enables users to select a suitable plan based on their risk appetite, while still allowing them to diversify across multiple digital currencies.

The Flexible Savings product accrues interest hourly, without tying up money, and allows for the addition or removal of assets at any point in time. The company’s public documents indicate that the functionality supports over 20 digital tokens, including widely used currencies such as Bitcoin (BTC), Ether (ETH), and Tether (USDT). Interest accrual is automatic, providing the users with a reasonably easy way to earn on idle balances. Its absence of strict time commitments makes it extremely attractive to investors who value the freedom to act spontaneously in response to market changes.

For those willing to lock up funds for a long term, the Fixed-Term Savings offering gives assured returns on fixed durations of 7, 14, or 30 days. Bitunix has stated that it includes VIP-only choices in this category, providing more returns for owners of larger balances or those meeting the requirements. The structure is an imitation of some of the fixed-income products more traditionally found in standard banking, with the bonus of crypto-based flexibility. Definite reward schedules and automatic reinvestment are implemented to minimize the need for manual processing.

The Dual Investment product is the highest-risk, highest-reward product in Bitunix Earn’s lineup. It allows users to set target prices and invest funds in a way that enables them to buy low or sell high, depending on the market direction at maturity. When the market price reaches or exceeds the target, the investment matures according to the agreed-upon terms, potentially yielding returns above those of conventional savings tools. Bitunix explains that it has a degree of exposure to volatility similar to that of options strategies in the regular markets. Therefore, it is more suitable for advanced participants who are familiar with managing volatility.

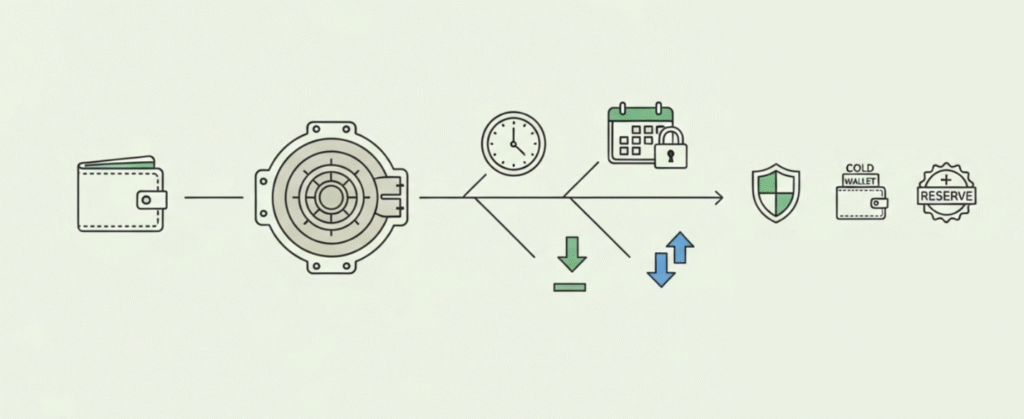

Bitunix reports that it holds over 95 percent of client funds in cold wallets, a type of offline storage that reduces exposure to cyberattacks. Two-step authentication is required for account access, and a withdrawal safelisting function provides an additional layer of control, allowing funds to be transferred only to approved destinations. The company also stated that a 15 percent risk reserve fund is supporting the program, serving as a buffer against unexpected events or market instability.

Bitunix’s minimum deposit amount is 1 USDT, with no redemption or subscription fees. This is an attempt to make the platform accessible to a larger pool of users, including small-time investors who would otherwise be deterred from entry by higher entry points. Reinvestment options, including automatic investments and interest-boosting coupons scheduled for release in the future, are designed to facilitate ongoing entry while rewarding continued participation. A wider performance dashboard also promises to give users clearer insight into earnings and risk levels.

The introduction of Bitunix Earn is part of larger trends in how cryptocurrency exchanges evolve to meet market demand. While trading becomes a central activity, exchanges increasingly compete on offering diversified financial products akin to those found in traditional investing and banking. Industry analysts have noted that the global market for crypto-based yield products is growing, as billions of dollars have been put into decentralized finance platforms and centralized exchange programs. Growth in the market indicates a sustained demand for alternatives to traditional financial instruments.

Bitunix, which operates in more than 100 countries and has daily trading volumes exceeding $5 billion, stated that it has developed Earn to complement its existing derivatives and spot trading options. The 2025 launch marks a move to build a broader ecosystem where active traders and passive investors can trade on a single platform. By adopting security features such as cold wallet storage and proof-of-reserves audits, the company aligns its revenue products with the same standards applied to its trading business.

Future developments, including auto-subscription functionality and deeper analytics, suggest that the Bitunix Earn suite is expected to grow beyond its initial release. The extent to which these developments will impact user uptake is uncertain, but they reflect an ongoing effort to refine the product in response to market dynamics and user feedback. Analysts and observers view this type of incremental development as a benchmark for competition in the digital finance sector.

As cryptocurrency-based financial products gain prominence, the ability of platforms to provide stable, transparent, and secure services will remain a decisive factor in their approval by regulators as well as adoption by users. Bitunix Earn is just one example of how traditional exchanges strive to keep pace with innovation while maintaining effective risk management. By the time the product line became official in April 2025, the arena for crypto passive income had already become more crowded, and differentiation based on flexibility and security was a strategic priority.

Leave a Reply